What are Public-Private Partnerships?

Overview

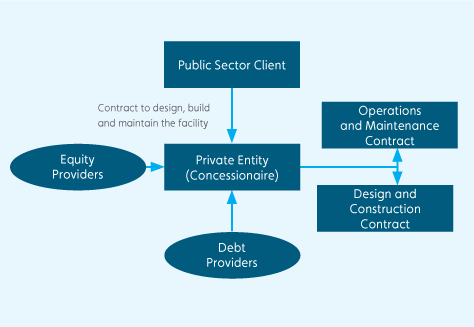

A PPP is a long-term contract between the public sector (a Public Sector Client) and a private company or consortium of companies (a Private Entity) covering the design, construction, maintenance, and financing of an infrastructure asset. PPPs can take many different forms, but typically have the following characteristics:

- a Public Sector Client enters into a contract with a Private Entity to provide finance and arrange the design, construction and ongoing operation of an asset. ‘On-going operation’ is usually limited to maintenance of the asset (but may extend to the provision of ancillary services, such as cleaning). The delivery of core social services to the public (such as the provision of teachers at a school or medical services at a hospital) typically remains the responsibility of a government agency;

the Public Sector Client undertakes to pay for use of an asset for a specified term normally ranging from 15 to 35 years (the Concession). The Concession represents a substantial part of the life of the asset

the Private Entity contracts out construction and facilities management under fixed-price terms thereby passing construction and operational performance risk to sub-contractors where possible; and

at the end of the Concession, ownership of the asset is returned to the Public Sector Client, who can continue to use the asset.

A key distinction between PPPs and traditional procurement methods is that the risks associated with the ownership and operation of an asset are largely borne by the private sector rather than public sector. An example of a Social Infrastructure PPP would be a hospital building financed and constructed by a Private Entity and made available for use by a local District Health Board. The Private Entity then provides housekeeping, building maintenance and other non-medical services while the hospital authority focuses on the delivery of core medical services.

The principal contractual relationships in a typical PPP are shown diagrammatically below:

Financing

PPP projects typically generate relatively stable and predictable cash flows over the term of a Concession. Because of the nature of these cash flows, Private Entities can support relatively high levels of debt. While debt levels are expected to be high initially (particularly, during the project construction phase) debt typically declines over the term of a Concession as it is repaid from operating cash flows. Further information regarding maximum permitted debt levels for the PIP Fund can be found in Section 8 on page 21 of the prospectus and investment statement of NZSIF.

A Private Entity will typically fund the initial project costs, including construction costs, through a mixture of long-term non-recourse senior debt, subordinated debt and equity. Ideally, where possible, senior debt and/or an equity bridging facility is drawn first and equity and subordinated debt are drawn towards the end of the construction phase (usually two-to-three years) to minimise calls on equity capital until the asset is operational.

Social Infrastructure PPP revenues

Once a Social Infrastructure Asset becomes operational, a Private Entity will receive revenues from the Public Sector Client for the remainder of the length of the Concession, provided agreed service levels are met. The revenues are typically inflation-linked and can be either 'availability’ or ‘demand’ based depending on the nature of the project:

- ‘Availability’- based projects entitle a Private Entity to receive regular payments from a Public Sector Client to the extent that the project asset is available for use in accordance with contractually agreed service levels.

- ‘Demand'- based projects entitle a Private Entity to receive payments related to the usage of the project asset.

The focus of the PIP Fund will be to invest in Social Infrastructure Assets through PPPs with availability-linked payments made by a Public Sector Client. The PIP Fund does, however, have the ability to invest in demand-linked projects subject to certain criteria.

Cash flows

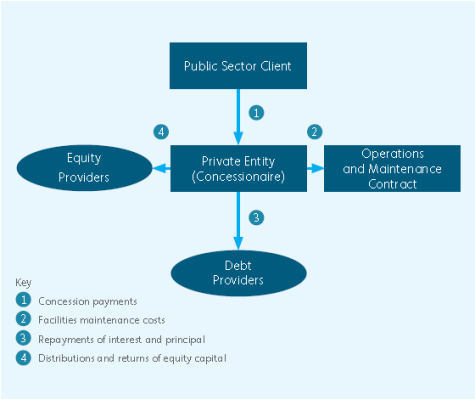

An illustrative example of the cash flows received / paid by a Private Entity for an operational asset is shown below:

In a typical PPP, assuming an asset is held until the end of the Concession, the cash flows to / from equity holders occur in two phases:

- Construction

During the construction phase, investors will be called upon to provide portions of their committed capital – known as draw downs or calls – as and when required. A typical build time for a new Social Infrastructure Asset might be two-three years and equity would be called in instalments during this period. - Operation

Concession payments to the Private Entity typically commence once an asset is constructed and considered operational (i.e. available for use) by the Public Sector Client. Revenues typically enable the Private Entity to repay the construction and finance costs, pay for asset maintenance and operation and provide an equity return for investors. Equity investors can receive an investment return on equity in the form of income (dividends or distributions of operating profits from PPP assets), periodic returns of investment capital, and potentially capital gains on sale of investments (if sold).

Typically, in the final few years of the Concession, once senior debt and subordinated debt are repaid from asset operating cash flows, all of an asset’s operating earnings will flow to equity investors (after providing for any required latter year capital expenditure).

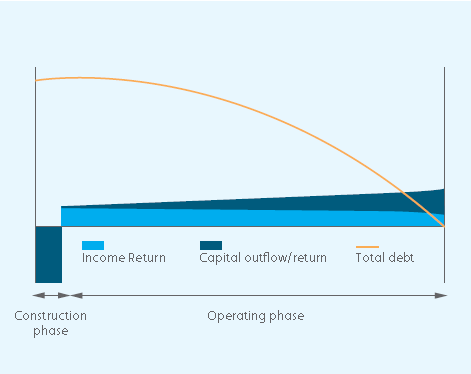

The chart below sets out an illustrative example of the annual cash flows to equity investors and the amortisation profile of project debt funding associated with a hypothetical PPP project.

• Equity outflows for investors typically occur during the construction phase as projects are designed, built and completed.

• Returns to equity investors during the operating phase are generated from Concession payments received from the Public Sector Client and can have both an income and a capital component.

• Income returns comprise either dividends or distributions of operating profits (before tax) from the Private Entity. Capital returns reflect periodic returns of investors’ invested capital. Capital returns tend to increase as the outstanding balance of debt funding is repaid over the term of the Concession.

• Cash flow streams are ideally relatively consistent during a Concession but can vary as a result of capital expenditure required to ensure the asset is returned to the Public Sector Client in a pre-agreed condition.